From 1 October 2025, the Scheme will remove limits to the number of Government guarantees available, giving all Australian first home buyers the chance to enter the market with a deposit of as little as 5% and avoid Lenders Mortgage Insurance.

What’s Changing in the First Home Guarantee Scheme from 1 October 2025

- No place limits: all Australian first home buyers who have saved a 5% deposit can apply.

- No income caps: first home buyers with higher incomes can access the Scheme.

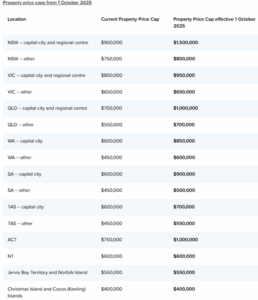

- Higher property price caps: to help home buyers where property prices have increased.

- Simpler access in regional areas: Regional First Home Buyer Guarantee will be replaced by the First Home Guarantee.

These reforms are significant because:

- Lower barrier to entry: With just a 5 % deposit (plus fees), eligible first-home buyers can avoid paying Lenders Mortgage Insurance (LMI), which often adds tens of thousands to upfront costs.

- Broader eligibility: Removing income caps and limits on places makes the scheme available to more people.

- Better alignment with actual property prices: Increased price caps means the scheme now reflects current market conditions.

Potential Challenges & Considerations:

- Increased competition: More people now eligible, may mean more demand in popular areas, pushing prices up further.

- Financial risk: With only 5% deposit, buyers carry more debt from day one. Falling home prices or interest rate rises could strain household budgets.

- Supply constraints: Without commensurate growth in housing supply, reforms may help buyers but won’t solve broader affordability pressures.

If you have any questions around this scheme, speak with your lender or financial adviser to ensure this would be suitable for you.

Written by

Gillian Burns

Mortgage Broker

Certificate IV in Finance and Mortgage Broking

Diploma of Finance and Mortgage Broking Management